Launch Online Investment products

Offer a variety of online investment products tailored to individuals using our investment platform.

Design online investment propositions

- Create your online investment platform and product offerings using Finslack investment workflows geared towards improving customers’ online investment experience

- Feature-rich admin console to manage your platform and customers

- Advanced KYC/AML technologies for seamless onboarding

- Embed Finslack investment capabilities to existing banking or non-banking products

Distribute investment products via custom channels

- Deliver your investment offerings through a custom web portal and branded mobile app

- Add complimentary financial products like deposit-taking and automated lending to expand your product offering

- Enhance your investment product use our APIs to integrate with third-party providers

Features to deliver world-class online investment experiences

Create multiple and diverse assets

- Our robust platform lets you design and manage multiple digital investment vehicles across a variety of asset classes from stocks and ETFs to crypto and more.

- Define product type and use custom fields to capture additional details.

Autopilot investment workflows

Design automatic investment workflows to let customers put their portfolios on autopilot without further input from their ends.

- Automated features include portfolio rebalancing, dividend reinvestment, and auto-adjustments.

Setup asset yields and service fees

- Determine, fix and adjust yield percentages or ROIs for assets available on your platform.

- Where needed, setup service fees charged against customers’ investment accounts.

- Design reward programs like deposit bonus, loyalty bonus and more to attract or retain users.

Seamless investment portfolio creation

Set AI workflows to let customers create investment portfolios based on their goals, risk appetite and current life situation.

- Onboard customers quick and easy relying on our Self-Onboarding feature, omnichannel and advanced AML/KYC technologies.

Manage invested portfolio pools

View customer funds invested across a broad spectrum of asset classes, on a single, integrated backend dashboard.

Comprehensive portfolio performance reports

Get a picture of your loan business performance at a glance

Financial statements for audits and tax authorities

User portfolio performance analytics

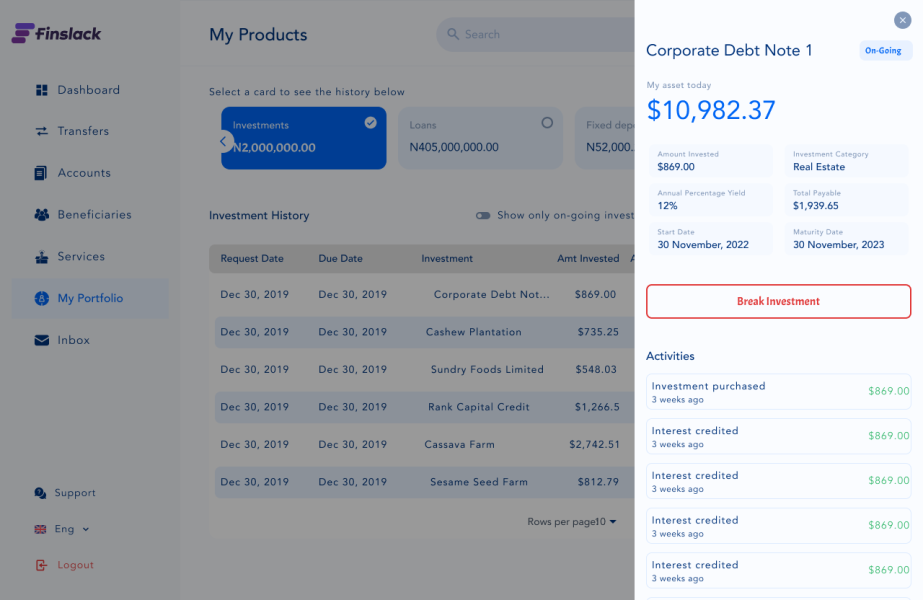

Clean customer-facing accounting dashboards to let users monitor their portfolio performance in real time.

- Enable automatic notification to alert users of key performance metrics or new digital assets

- Periodic performance reports and statements forwarded to users via mail

Key features that make it all possible

Fully Compliant

We own compliance and have done the heavy lifting of reducing the risk of financial fraud so you can run your business smoothly.

Maximum Security

Prevent unauthorized access to tools using cutting-edge security technologies. Distribute access rights to your staff with varying authorizations.

Customizable

Our suite of flexible components and APIs lets you build out unique functionalities, integrate third-party services and brand your product.

Reliable

Finslack robust and multi-tenant architecture allows multiple clients' systems to run concurrently on a central server with 99% system uptime.

PARTNERS

Our Plug and Play Ecosystem

Our industry-leading partners are pre-integrated into Finslack to provide solutions across

Banking-as-a-Service, credit, loan management, KYC and more.

See what else you could build

The easiest way to launch your financial product