Offer account holders attractive deposit products

Configure a variety of deposit-based offerings to help customers save money, receive funds, pay bills and more. Manage customer accounts and deposit portfolios with ease whether you are a financial institution or not.

Develop bespoke deposit products effortlessly

- Customise Finslack to create deposit products with made-to-order variables (interest rate, period and commission) through scalable, low-code/no-code configurations.

- Iterate and test your deposit and transactional ecosystem with resources and APIs designed to reduce development costs.

- Launch new deposit products in a matter of 21 days. That’s faster than legacy core technology providers can offer.

- Launch your deposit ecosystem as part of a digital banking proposition or part of a wallet system within a non-banking product.

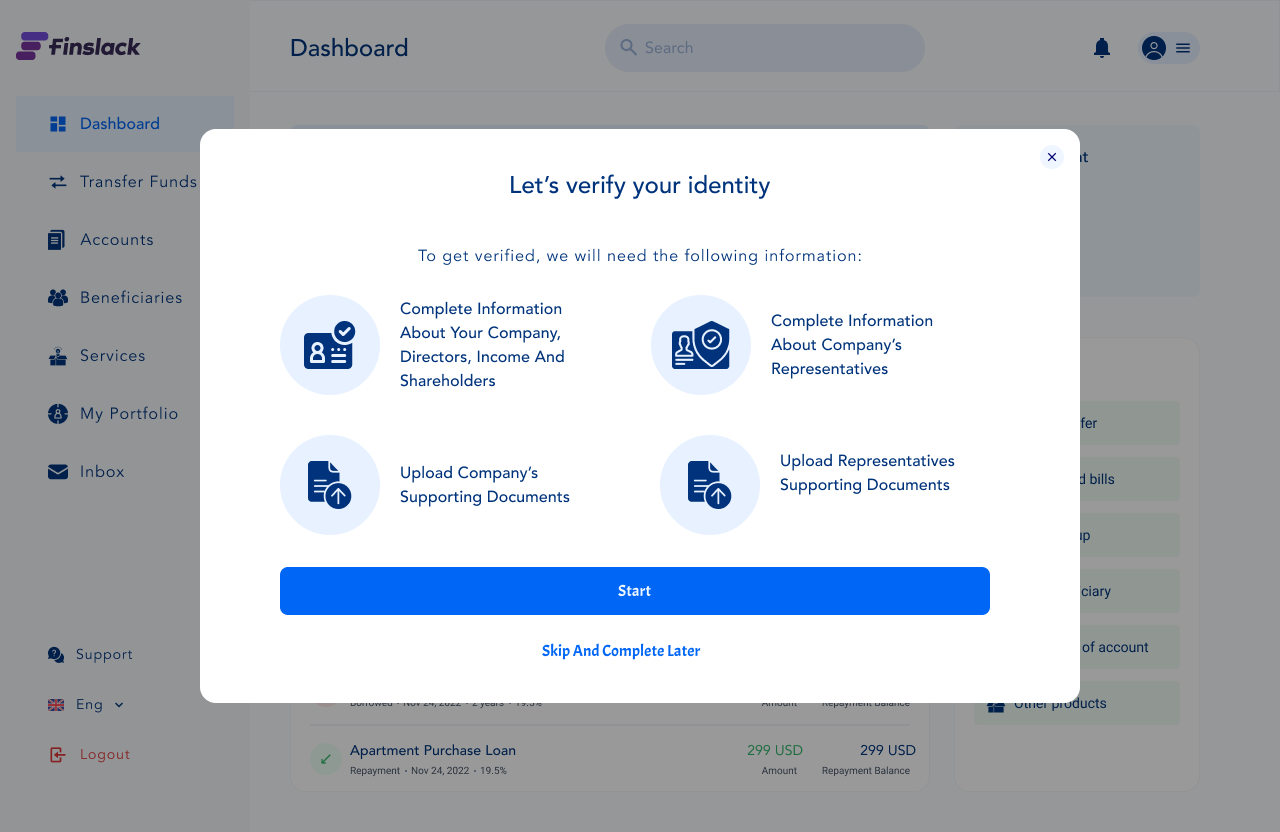

Cover compliance and operational risks

- Best-in-class and country-specific AML/KYC tools

- Integrate other regulatory constraints throughout the lifecycle and adapt to local regulatory and market specificities

- Onboarding customers seamlessly using simple KYC fields and advanced tools like biometrics and facial recognition

- Set product eligibility conditions like requirements for opening an account, and the terms of use (e.g. minimum deposits, ceilings, withdrawals, premiums, penalties and more)

Manage and improve your offerings with ease

- Administrative backend to handle the daily management of your deposit system. View operational and performance metrics, generate reports, reconcile accounts with host banks, adjust configurations, engage users, assign roles and do more.

- Upgrade, enhance or migrate deposit offerings of all types, anytime based on user needs, and dynamics of market or sales channels.

- Add other Finslack digital banking solutions like lending, e-wallet, and investments or integrate third-party solutions to further enrich your deposit offering

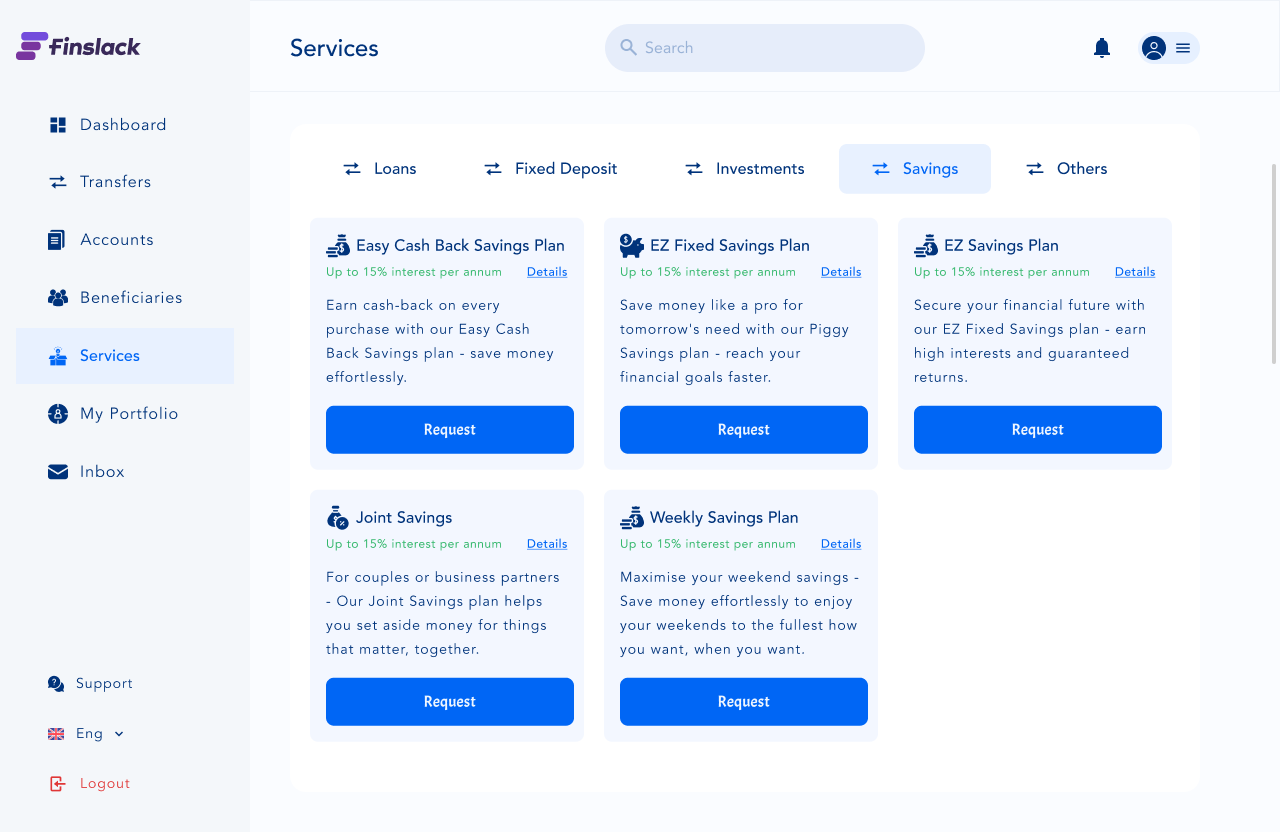

Deliver only best-in-class deposit propositions

Flexible money savings

Offer flexible term saving plans and provide full deposit support services such as maturity terms, interest rate calculations, tax deductions, enforcing maximum account balances and setting withdrawal limits based on account tier.

- Users can save in as many currencies as you support

- Set up interest rates on different saving plans (fixed, variable, indexed, and more)

- Set up charges for deposit services

- Notify users of maturity payouts

Stored-value offers

Create different types of stored-value payment instruments customers would love. Leverage our wide range of trusted channels from cards to merchant terminals to enable seamless saving and use of stored values.

- Support all kinds of stored value cards

- Store digital units and tokens like coupons

Detailed Reporting and Correspondence Suite

Custom dashboards and reporting to help you track key operational and performance metrics across savings products.

- Generate account statements for users on-demand or send them out monthly

- Reports for internal or external auditing

- Upcoming maturities notification and report (for term deposits)

- CIO Report

- Account reconciliation with host banks

Omnichannel ecosystem

Through integrations, customers can access, transfer, debit or deposit money from their deposit or savings accounts in agency outlets or via card, e-banking, an ATM, and more.

- Access deposit account via web portal and mobile app (SDK available)

- Endless integrations (add as many third-party channels for deposit and withdrawal as required)

Cryptocurrency savings

Provide secured accounts for crypto asset deposits and withdrawals whether you're building a cryptocurrency exchange or adding a crypto wallet to your product.

- Allow as many crypto accounts as your business can support

- Seamless transfer of funds from fiat to crypto & vice versa

- Set competitive interest rates applicable to crypto savings

- Manage exchange rates

Flexible overdraft

Simplify the management of arranged and technical overdrafts. Include support for interest rate calculations, implementing additional outstanding loan fees, and setting customizable maximum overdraft limits as required.

- Set overdraft fees and apply other late payment charges as you see fit

- Provide overdraft protection

- Automatic reporting of overdraft and interest repayment

Platform features that make it all possible

Fully Compliant

We own compliance and have done the heavy lifting of reducing the risk of financial fraud so you can run your business smoothly.

Maximum Security

Prevent unauthorized access to tools using cutting-edge security technologies. Distribute access rights to your staff with varying authorizations.

Customizabe

Our suite of flexible components and APIs lets you build out unique functionalities, integrate third-party services and brand your product.

Reliable

Finslack robust and multi-tenant architecture allows multiple clients' systems to run concurrently on a central server with 99% system uptime.

PARTNERS

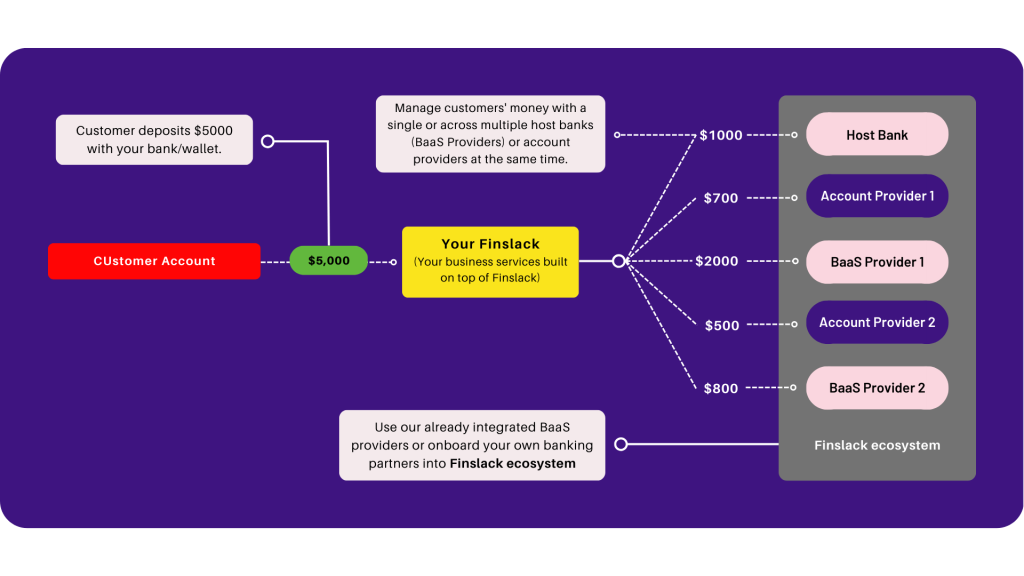

Our Plug and Play Ecosystem

Our industry-leading partners are pre-integrated into Finslack to provide solutions across

Banking-as-a-Service, credit, loan management, KYC and more.

See more Digital Banking use cases

The easiest way to launch your financial products