Hassle-free approach to profitable mortgage lending

Configure a variety of deposit-based offerings to help customers save money, receiveLaunch highly innovative retail mortgage products in days, not months.

Automate the entire mortgage lending lifecycle to improve operational efficiency and simplify the experience for borrowers. funds, pay bills and more. Manage customer accounts and deposit portfolios with ease whether you are a financial institution or not.

Innovate with full front-to-back-office lending ecosystem

Explore a suite of dynamic stacks, workflows and integrations from an ecosystem of pre-integrated partners — all designed to support your end-to-end mortgage lending process from loan origination to servicing and more.

- Configure your mortgage solution in days

- Automated workflows to reduce manual input and save costs

- Work with pre-integrated partners or onboard yours to deliver exceptional offerings

- Stay compliant with advanced and country-specific AML/KYC processe

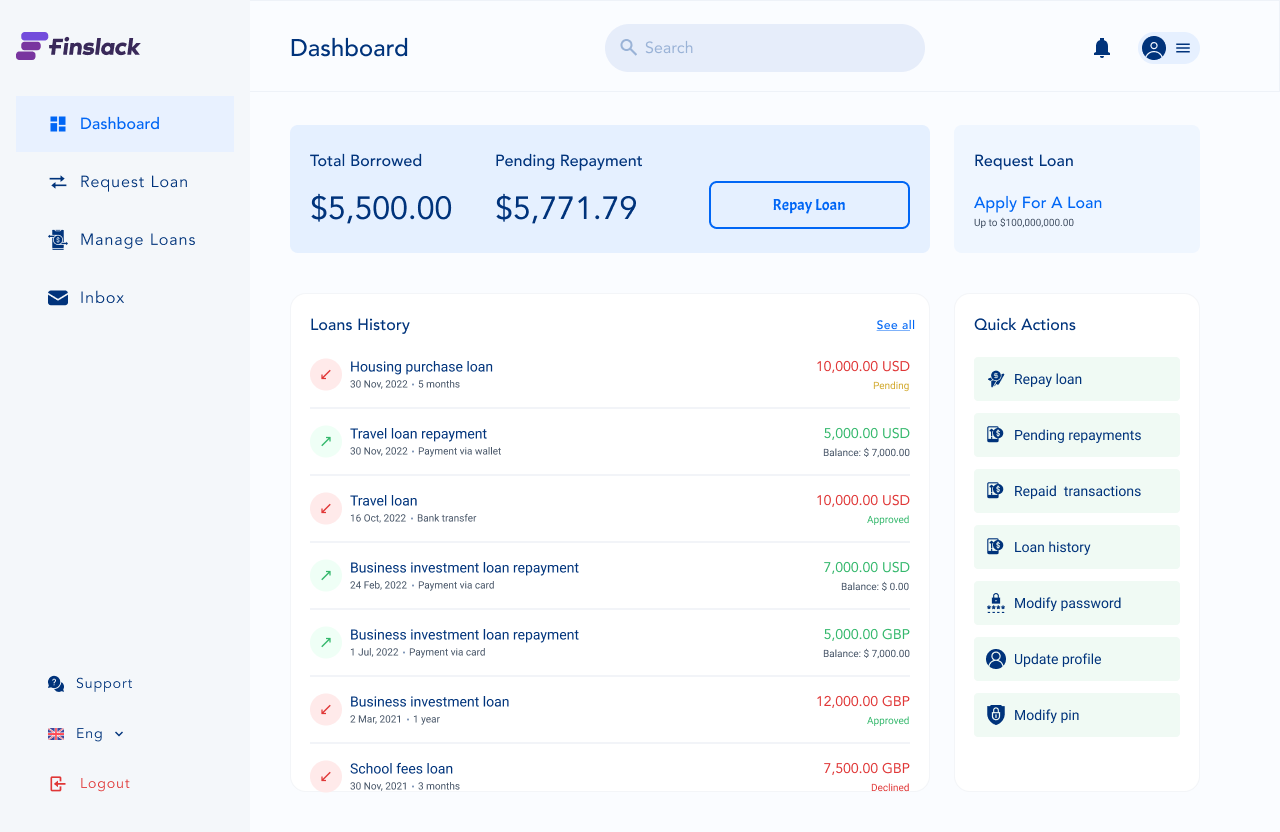

Deliver next-level mortgage lending experience

- Enhance user experiences through the use of guided applications, clean UIs streamlined documentation and instant loan approvals, and enhanced data visibility.

- Create a clear workflow for engaging borrowers, processing crucial documentation, servicing loans and handling loan forbearance or default.

- Make your mortgage product accessible via the web portal or mobile apps (iOS and Andriod)

Manage and improve your offerings with ease

- Administrative backend to handle the daily management of your deposit system. View operational and performance metrics, generate reports, reconcile accounts with host banks, adjust configurations, engage users, assign roles and do more.

- Upgrade, enhance or migrate deposit offerings of all types, anytime based on user needs, and dynamics of market or sales channels.

- Add other Finslack digital banking solutions like lending, e-wallet, and investments or integrate third-party solutions to further enrich your deposit offering

Innovations that put you ahead of the curve

Automate mortgage loan application

Automate mortgage loan applications through a single portal with a unified process across multiple channels and devices.

- Automatic application data collation

- Instant verification of client’s information

- Omnichannel and self-onboarding process

- Fraud detection

Low-cost mortgage loan servicing

Automate loan servicing after disbursal including interest rates and fees calculation, tracking repayments, notifying mortgagors of payments due, and collecting payments.

- Automated debt collection system

- Save millions in remediation costs caused by errors in manual loan servicing

- Track payments, account statements, and collaterals

Endless integrations

With our APIs, you can integrate with top providers inside or outside of our ecosystem to deliver an optimal borrower experience for your mortgage product.

These enable you to handle everything from loan origination, approval, disbursement, and servicing, to reducing operational costs and innovating further.

Fast mortgage loan origination

Completely automated mortgage loan origination. Our system seamlessly handles mortgage loan applications by using client data to auto-underwrite risks, conduct quality checks, make credit decisions and approve loans.

- Configure loan engine to make credit decisions in line with business goals

- Originate loans in minutes

- Timely decisioning, approval and access to loans

On-demand flexibility

Quickly respond to customers’ changing needs and market trends at any time with our flexible configuration.

You can introduce new products or pull down existing ones, adjust loan terms, or rework rescheduling or refinancing terms to stay competitive. Change interest rates on demand, and react fast to loan forbearance or default.

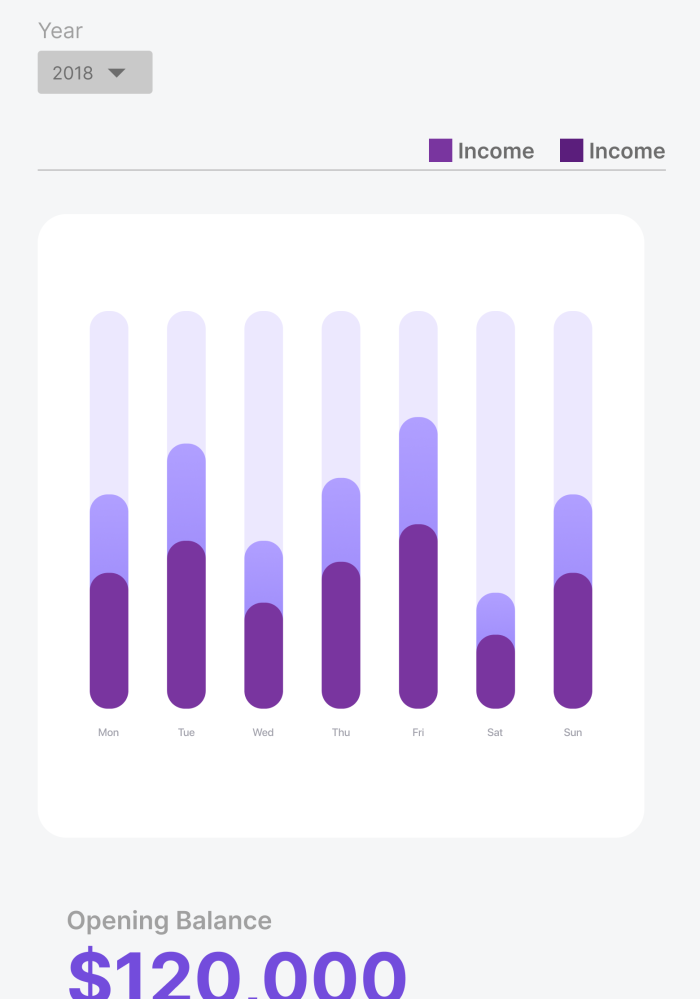

Powerful analytics

View detailed charts to see how your loan releases are performing each month. You can also view cash flow reports and profit/loss statements.

Establish cross-functional referrals with a 360-degree view of borrower information and leverage that data to create additional products.

More innovation for exceptional delivery

- Verification

- Credit reports

- Flood determination

- Appraisal

- Financial service cloud

- eClosing

- Repayment schedule

- Reduced interest facilities

- Interest rates management

- Tax transcripts

- Mortgage insurance

- Fraud detection

- Automated underwriting

- Pricing and hedge analytics

- CRM Analytics

Platform features that make it all possible

Fully Compliant

We own compliance and have done the heavy lifting of reducing the risk of financial fraud so you can run your business smoothly.

Maximum Security

Prevent unauthorized access to tools using cutting-edge security technologies. Distribute access rights to your staff with varying authorizations.

Customizabe

Our suite of flexible components and APIs lets you build out unique functionalities, integrate third-party services and brand your product.

Reliable

Finslack robust and multi-tenant architecture allows multiple clients' systems to run concurrently on a central server with 99% system uptime.

PARTNERS

Our Plug and Play Ecosystem

Our industry-leading partners are pre-integrated into Finslack to provide solutions across

Banking-as-a-Service, credit, loan management, KYC and more.

See what else you could build

The easiest way to launch your financial product