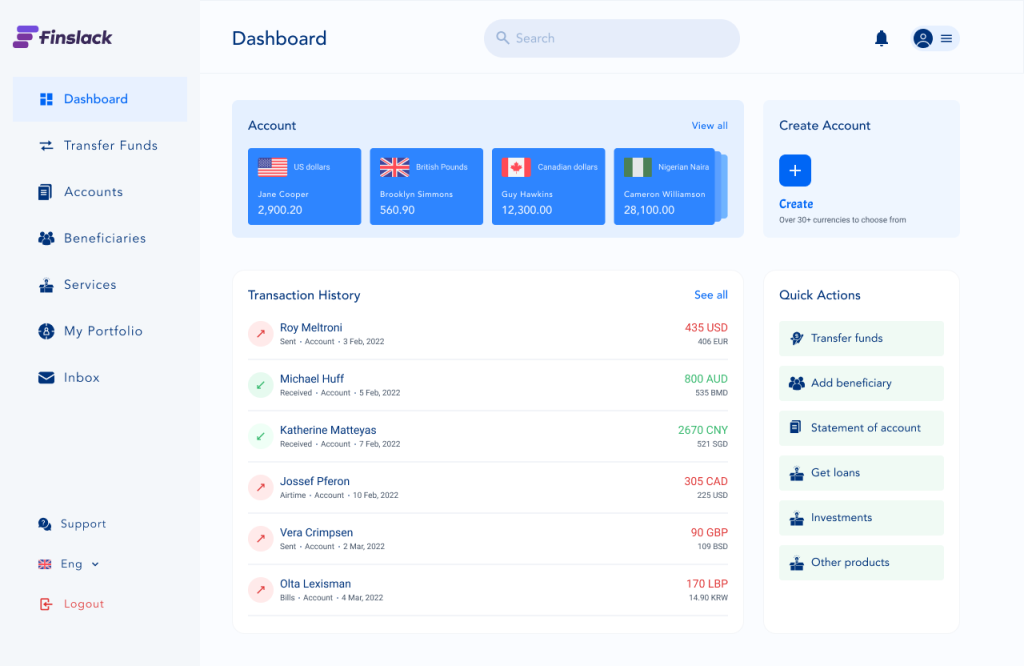

Launch Virtual Account Management solution in days

Issue, view and manage pooled accounts, customer money,

cash and liquidity positions, and in-house banking

via a single touchpoint.

Simple virtual accounts for your customer’s banking needs

- Seamless integration with existing accounts and real-time updates via Open Banking.

- Business and personal account opening with pre-integrated compliance tools for onboarding.

- Unique account IDs for flexible banking and improved transaction monitoring.

Self-managed accounts to save you time with customer support

- Automated bank reconciliation and simple configuration to support complex banking needs.

- Whitelabel platform and intuitive design across web and mobile.

- Handle historic or bespoke account configuration with CSV uploads supported.

- Design and open complex virtual or shadow account hierarchies and payment routing for a real physical account maintained in the bank core banking ledger.

Virtual account functionalities you can do with Finslack

Multi-currency and FX

Seamlessly issue fiat or crypto account products to customers. Automate the account issuing process by configuring account allocation rules.

- Virtual Closed Loop or Openned Loop accounts

- Automate account issuing process

- Users access accounts via web or mobile apps

Secure client money management

View clients’ transaction activities in real-time and manage funds. Finslack complies with regulatory requirements across the globe.

- Smooth transaction allocations

- Internal and external reconciliations

- Banking and reporting

Setup and manage interest rates

Set up earnable interest rates and commissions for users depending on users’ account balances. Great for encouraging clients to increase deposits or reduce balance holdings.

- Set interest percentages and terms

- Set duration of rates

- Interest payouts

Streamlined banking

Reduce costs by creating multiple sub-ledger virtual accounts under a single real bank account

- Multi-entity hierarchical virtual account structure

- Easy segregation of inflow or outflow of funds

- Easy account indemnification

- Accurate reconciliations

Seamless onboarding

Instantly onboard customers while delivering exceptional experiences across multiple channels. Automate onboarding processes like eKYC checks, auto approvals and more.

- Clean onboarding user interfaces

- Advanced KYC/KYB Levels

- Photo & video verifications

- Document scan and review

Accounts receivable and ledger control

Automate collection, allocation and control of money received into users’ virtual accounts with corresponding remittance updates on sub-ledgers.

- Streamline payment collection

- Improve visibility of payment data

- Cut costs

Key features that make it all possible

Fully Compliant

We own compliance and have done the heavy lifting of reducing the risk of financial fraud so you can run your business smoothly.

Maximum Security

Prevent unauthorized access to tools using cutting-edge security technologies. Distribute access rights to your staff with varying authorizations.

Customizable

Our suite of flexible components and APIs lets you build out bespoke functionalities, integrate third-party services and brand your product.

Reliable

Finslack robust and multi-tenant architecture allows multiple clients' systems to run concurrently on a central server with 99% system uptime.

PARTNERS

Our Plug and Play Ecosystem

Our industry-leading partners are pre-integrated into Finslack to provide solutions across

Banking-as-a-Service, credit, loan management, KYC and more.

See what else you could build

The easiest way to launch your financial product