Configure digital lending with ease

Cutting-edge loan engine to configure and automate your smart lending platform. Offer loans and make smarter credit decisions faster.

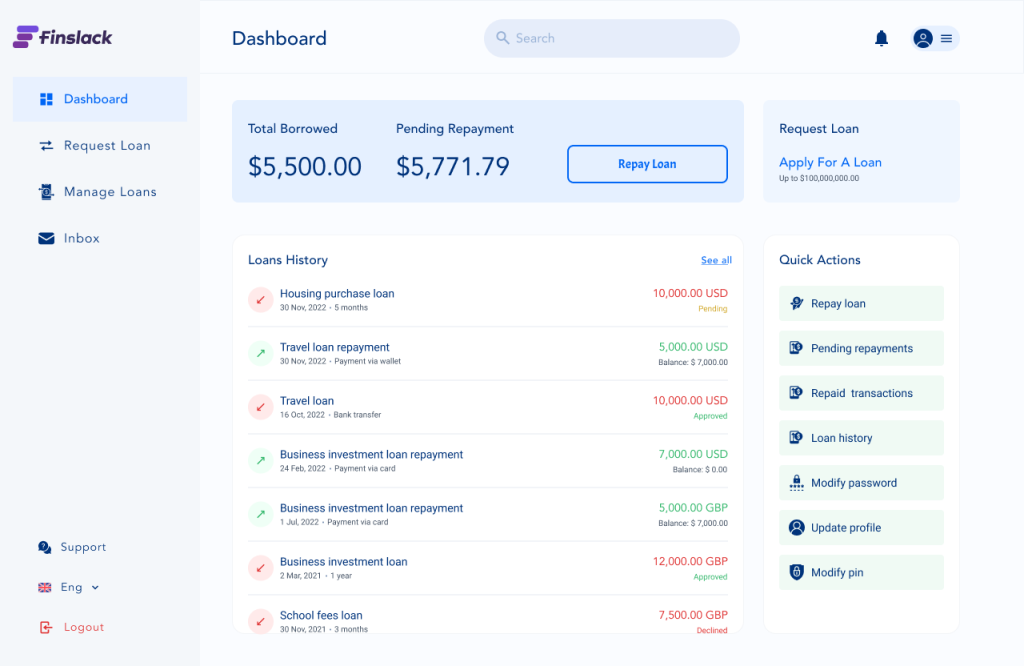

Create and manage loan products

Effectively manage your lending with smart digital tools geared towards securing your business and improving clients’ lending experience.

- Credit decision engine

- KYC and onboarding

- In-life collections management

- CRM integration

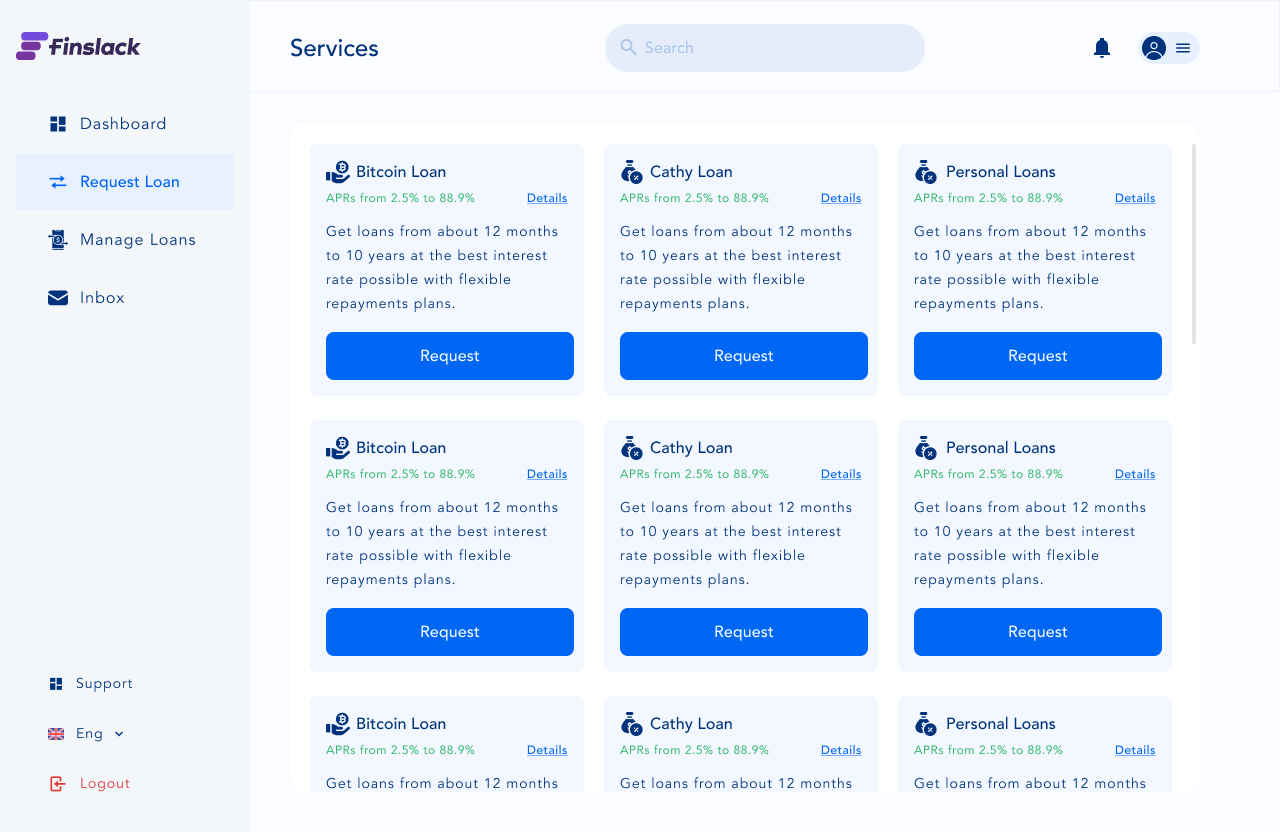

Distribute loan products via custom channels

Extensive plug and play integrations. Customers access your loan product through a custom web portal or SDK loan mobile application.

- Create your app customer interfacing using our UI components or API

- Seamless eligibility verification and onboarding

- iOS and Android

- Embedded finance

Features that ensures a successful loan business

Originate loans

Automate and manage your loan application and disbursal process. An automated verification system underwrites loan applications, makes credit decisions, and performs quality checks using clients’ data.

- Automate data collation

- Digital verification of client’s information

- Integrate third-party solutions into your loan system

Debt factoring

Manage the purchase, collection, or resell of debts collected. Buy delinquent or charged-off debt at a fraction of the debt's face value, track and manage debt collection or resell all or portions of the debt.

- Full access to debtors’ data

- Automated debt collection system

- Track communication between your employees and debtors

- Flexibility to retain or resell debt collected

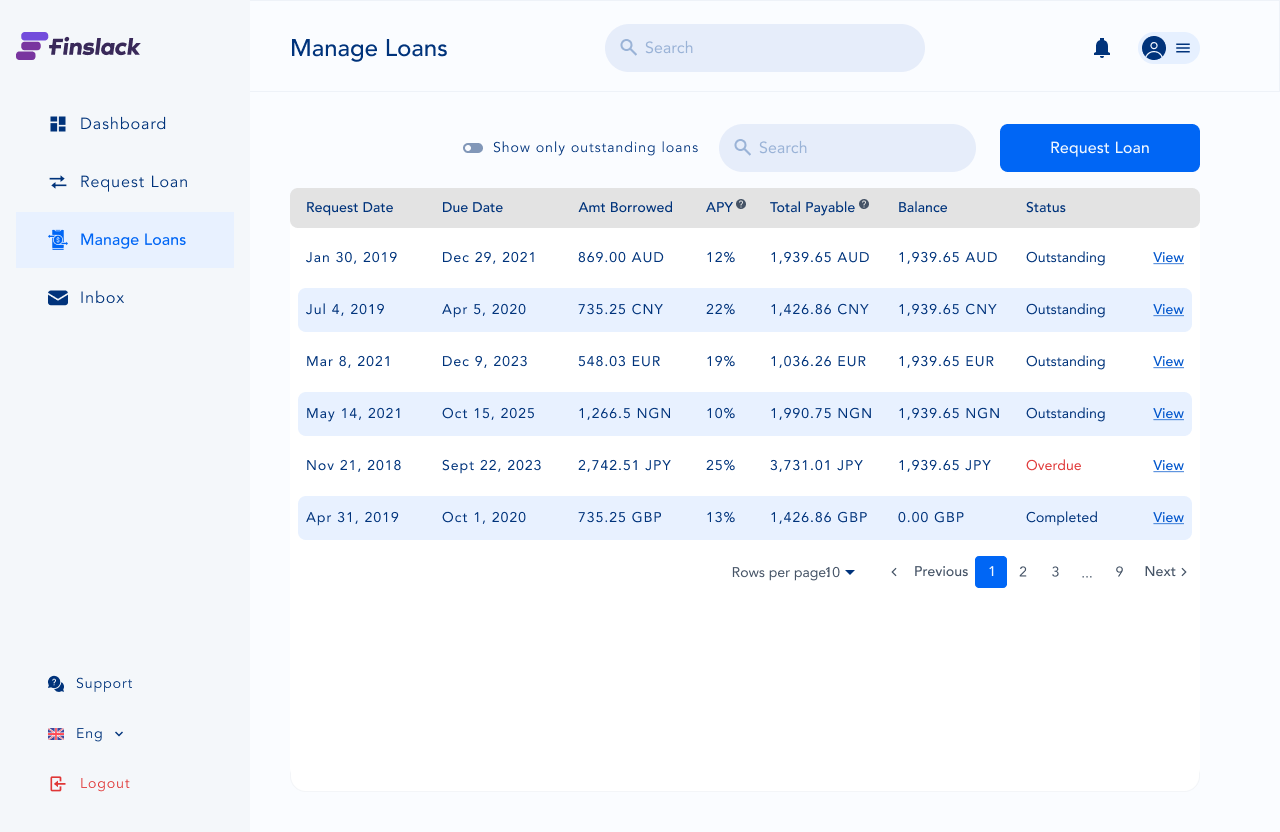

Loan repayment schedule

Let your clients and employees track and manage periods of loan repayment. Loan information is broken down into principal, interest, and other elements in the amortization schedule.

- Notify clients ahead of loan repayments

- Schedule interest rates for early and late payments

- Comprehensive loan information analytics

Service loans

Automate all loan activities after disbursement to the borrower. Automated activities include updating clients' information, calculating interest rates and fees, notifying borrowers of payments due, and collecting payments

- Automated debt collection system

- Reduce servicing costs

- Track payments, account statements, and collaterals

- Notify borrowers of payment due dates

Loan accounting

Monitor disbursed loans, repayments and cashflows. Get analytical insights into business and marketing data like clients’ profiles, conversion rate, company turnover, and more

- Loans and repayments status

- Transaction and comprehensive turnover reports

- Get a picture of your loan business performance at a glance

- Financial statements for audits and tax authorities

Key features that make it all possible

Fully Compliant

We own compliance and have done the heavy lifting of reducing the risk of financial fraud so you can run your business smoothly.

Maximum Security

Prevent unauthorized access to tools using cutting-edge security technologies. Distribute access rights to your staff with varying authorizations.

Customizable

Our suite of flexible components and APIs lets you build out bespoke functionalities, integrate third-party services and brand your product.

Reliable

Finslack robust and multi-tenant architecture allows multiple clients' systems to run concurrently on a central server with 99% system uptime.

PARTNERS

Our Plug and Play Ecosystem

Our industry-leading partners are pre-integrated into Finslack to provide solutions across

Banking-as-a-Service, credit, loan management, KYC and more.

Loan products you can build

The easiest way to launch your financial product

Offer instant payday loans to customers with verified employment status. Manage loan underwriting via automated processes.

Virtual Account Management

Issue and manage pooled virtual accounts and in-house banking via a single touchpoint.