Facilitate Payday Loans

Offer instant, short-term payday loans to customers with confirmed employment status. Manage your payday loan product with ease.

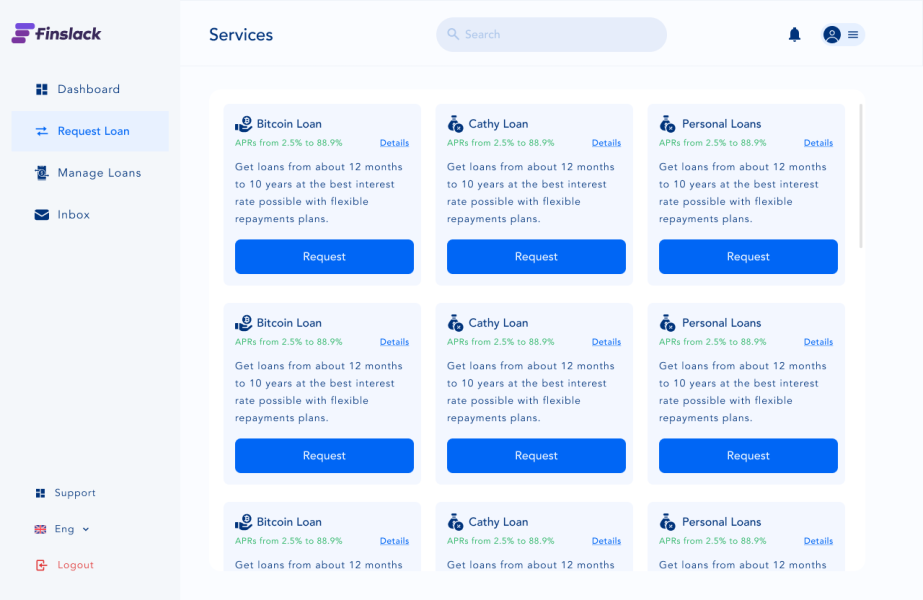

A complete suite to design and launch payday loans

- Create a variety of payday loan products by configuring our loan engine.

- Effectively manage your payday lending products with smart digital tools to secure your business and improve clients’ lending experience.

- Smart and automated credit decision engine to ease loan underwriting and onboarding.

Add payday loan to existing loan offerings

- Use our APIs to integrate our payday loan solution to whatever suite of loan products you may already have.

- Deliver a web portal and branded mobile app to let customers access your loan offering.

- Integrate with third-party providers to enhance your offerings.

Finslack Payday Loan Features

Automatic loan underwriting

- Our AI-powered verification system underwrites loan applications by taking into account borrower’s financial data and determining credit-worthiness

- Advanced KYC technology checks borrower’s data for previous financial crimes or bad debt records

- Instant disbursal of loan if the borrower passes verification checks

Set interest rate and loan duration

Determine interest rate chargeable on your payday loans and apply

- Modify interest rate at any time as your business requires

- Set loan durations for each payday loan

- Add loan calculator to help customers see payback value for selected durations before applying for loan

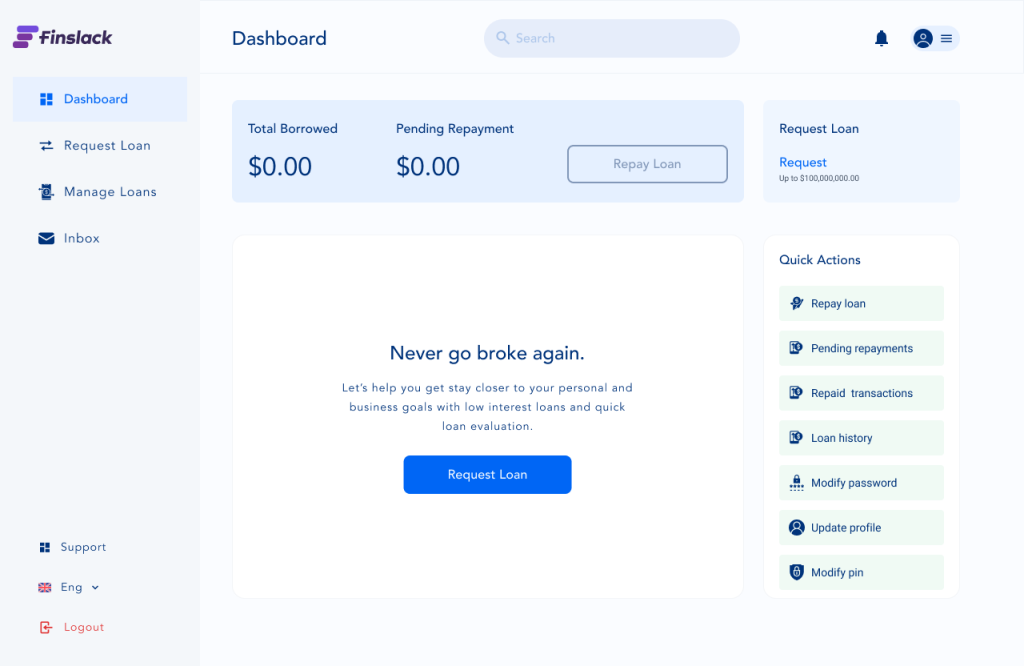

Automatic repayment schedule

- Create workflows to enable automatic debiting of customer’s bank accounts for loan instalments

- Track loan repayment data from your admin console and manage late repayments

- Setup automatic notifications to notify clients ahead of loan repayments

- Schedule interest rates for early and late payments

Seamless loan servicing

Automated activities include updating clients’ information, calculating interest rates and fees, notifying borrowers of payments due, and collecting payments.

- Automated debt collection system helps reduce servicing costs

- Track payments, account statements, and collaterals

Payday loan accounting

Monitor disbursed payday loans, repayments and cashflows.

- Get analytical insights into business and marketing data like clients’ profiles, conversion rates, company turnover, and more.

- View Loans and repayments status and comprehensive loan reports

- Financial statements for audits and tax authorities

Key features that make it all possible

Fully Compliant

We own compliance and have done the heavy lifting of reducing the risk of financial fraud so you can run your business smoothly.

Maximum Security

Prevent unauthorized access to tools using cutting-edge security technologies. Distribute access rights to your staff with varying authorizations.

Customizable

Our suite of flexible components and APIs lets you build out unique functionalities, integrate third-party services and brand your product.

Reliable

Finslack robust and multi-tenant architecture allows multiple clients' systems to run concurrently on a central server with 99% system uptime.

PARTNERS

Our Plug and Play Ecosystem

Our industry-leading partners are pre-integrated into Finslack to provide solutions across

Banking-as-a-Service, credit, loan management, KYC and more.

See what else you could build

The easiest way to launch your financial product