Launch a custom digital bank in weeks

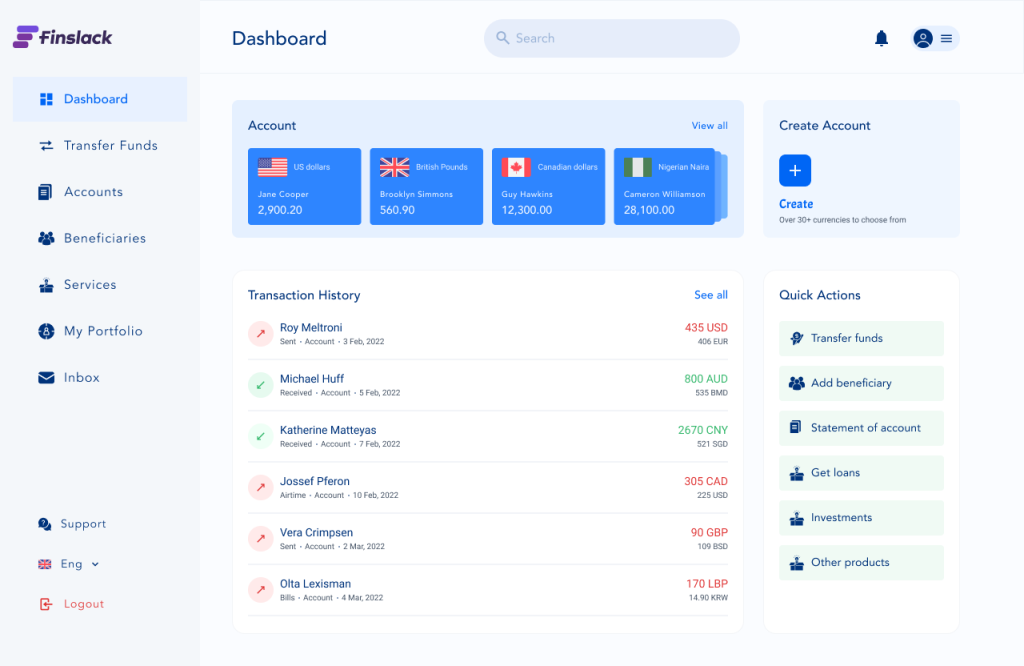

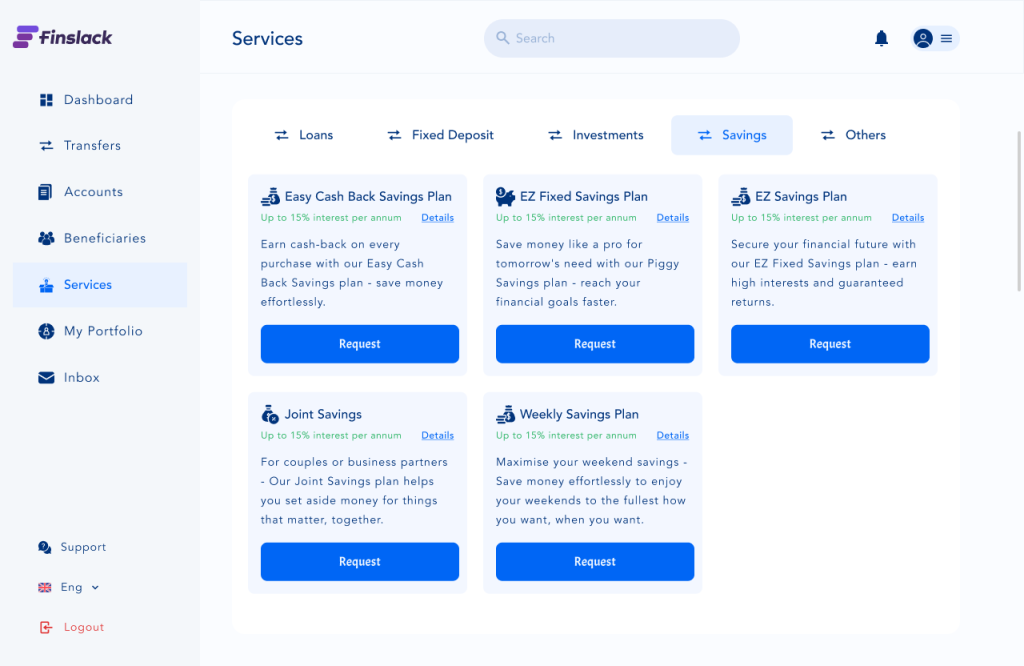

Design your own digital bank that offers complete financial services to customers, from savings accounts, bill payments and cards, to lending, investment products and more.

Offer custom financial services

Existing banks are not meeting the diverse needs of customers, Finslack offers you the fastest way to set up a neobank that nails the banking demands of your customers.

- Customizing Finslack’s UI and system workflows to create unique functionalities within your product

- Integrate with our solutions to build your neobank on top of our infrastructure

- Reduce cost and launch to market faster

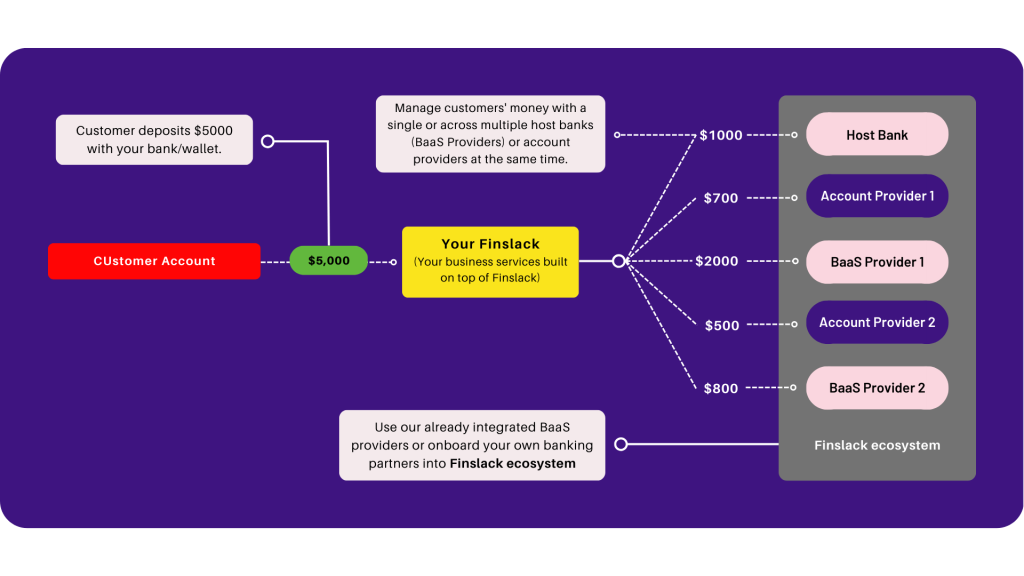

Build on the banking license of our BaaS partners

- A banking license is mandatory to meet the regulatory requirements of setting up a neobank. However, the acquiring process is both capital and time-intensive

- Finslack partners with Banking-as-a-Service providers with EEA licenses so you can deliver financial services cost-effectively without having to go through the process of acquiring a license

- Choose host banks from our ecosystem or onboard yours

Mirror customer funds across multiple host banks

Break free from partner-locking a single host bank or Banking-as-a-Service platform.

Plug into Finslack’s fast-expanding ecosystem of banks and BaaS platforms so you can hold customers’ money across multiple banks at a time without friction.

All you need to launch your neobank, in one solution

Seamless onboarding

Leave the regulation to us and seamlessly onboard your clients through smart KYC/AML processes.

- Omnichannel and automated onboarding process

- Physical ID verification

- Photo & video verifications

- Integrate with third-party KYC services

Offer and Manage Overdrafts and Loans

Offer loan products to your services and extend overdrafts upon customer requests. Set up eligibility criteria, fees, interests and other loans/overdrafts parameters.

- Automation lending process

- Advanced eligibility checks

- Credit score ratings

- Debt refactoring

Banking on the go

Customer-facing web and mobile apps with white-label design and built-in customer support systems to engage in real-time.

- Offer customers an omnichannel banking experience

- Internet banking and mobile banking app

- Secure access to accounts and transaction records

Issue payment accounts to customers

Offer your customers secure, feature-rich accounts built on our partners' fully regulated BaaS platforms. Issue complete and personalized e-wallets to users.

- Multi-currency accounts

- Issue IBANs internal account number, sort codes, SWIFT/BIC

- International and local payment rails

- Reconciliation tools

Enable payments and transfers

Create a seamless way for customers to send & receive batch payments, wire transfers, ACH, card, cross-boarder, QR codes and even cryptocurrency payments.

- Rely on our compliance expertise to reduce the risks of borderless banking

- Integrate new payment tools anytime

- Charge transparent fees and taxes

- P2P transactions

Embedded finance

Third-party integrations that offer richer services to customers. Use our own solutions or onboard yours.

- Issue physical and virtual branded cards

- Seamless integrations

Speed

Complete the design, testing, deployment and launching of your neobank within days, not months.

Open Banking

A suite of banking components to create unique functions and banking services by simple plug-and-play.

Cost-effective

Great value for a single product that covers business, regulatory and technological hurdles plus lifetime support.

See how Finslack helped Kogopay build a socially conscious startup that provides virtual IBANs and mobile wallets to customers

Why launch your neobank with Finslack?

Fully Compliant

We own compliance and have done the heavy lifting of reducing the risk of financial fraud so you can run your business smoothly.

Maximum Security

Prevent unauthorized access to tools using cutting-edge security technologies. Distribute access rights to your staff with varying authorizations.

Customizabe

Our suite of flexible components and APIs lets you build out unique functionalities, integrate third-party services and brand your product.

Reliable

Finslack robust and multi-tenant architecture allows multiple clients' systems to run concurrently on a central server with 99% system uptime.

PARTNERS

Our Plug and Play Ecosystem

Our industry-leading partners are pre-integrated into Finslack to provide solutions across

Banking-as-a-Service, credit, loan management, KYC and more.

See what else you could build

The easiest way to launch your financial product