Launch cross-border payments in minutes

Offer local and international money transfer services. Let customers pay bills, shop online or offline, make bank or m-money transfers, top-up airtime and more from anywhere in the world.

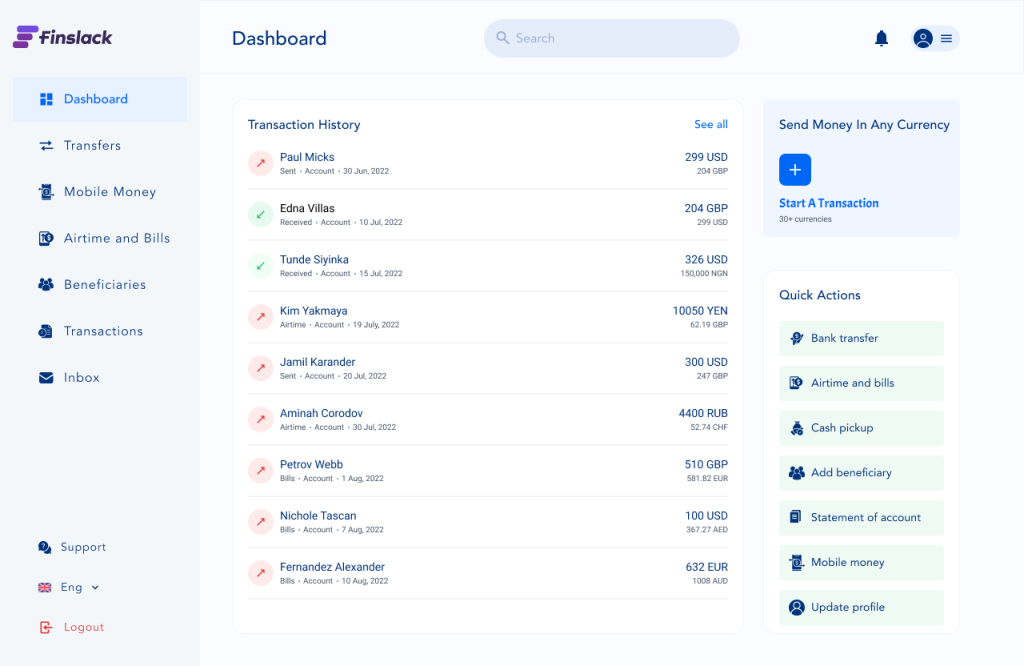

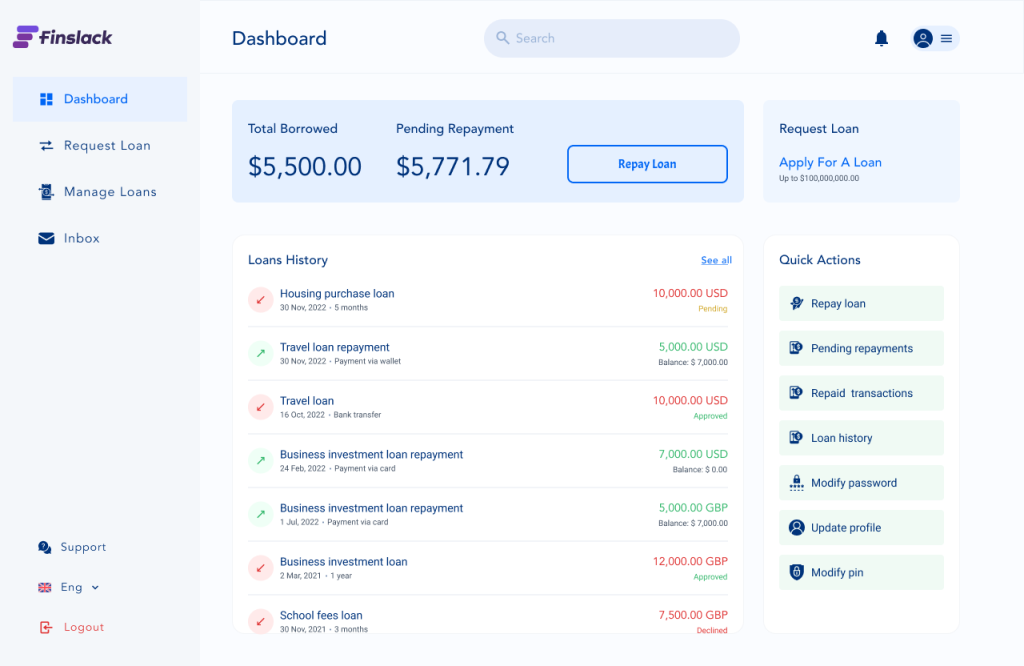

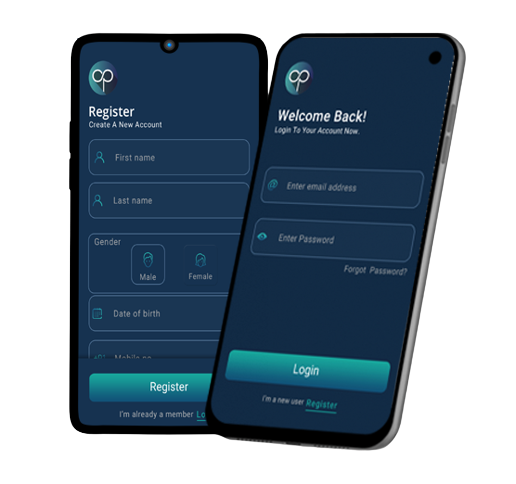

Own your full branded web and mobile remittance apps

Fully customize your remittance mobile application and web portal using our UI components and flexible workflows or build out your using our APIs.

- Setup workflows for your remittance app

- Support as many fiat and cryptocurrencies payments as your customers require

- Brand your payment product UI and launch

- Web portal and mobile app (Andriod and iOS)

Seamless administrative console

Manage your business through a complete administrative backend designed for efficiency and convenience.

- Leverage and setup smart AML and KYC rules to guide your business

- Configure and manage your own exchange rate, fees, commissions and tax rates

- Super-admin access gives you complete control over your business from agents to employees

Embed remittance into your product

- Simplify cross-border payments for customers by adding international remittance capabilities to your product using our APIs

- Powerful automation to streamline remittance business operations

- Enable merchants to collect wallet, credit card or bank payments

- Collect payments on behalf of merchants and manage payout

Designed for the way your customers move money

Bank transfer and Cash pickup

Your customers can send money through online or SMS bank transfer or agent locations and have beneficiaries withdraw funds through their banks or pick up cash at agent locations near them.

- Bank transfer and cash pick-up in over 70 countries

- Online and SMS bank transfer

- Leverage agency network to facilitate cash payment and cash pickup

Mobile airtime top-up

Enable mobile airtime top-up within your remittance app to let your customers top up a click from anywhere worldwide. This creates additional revenue for your business

- Facilitate mobile airtime top-up to over 140 countries

- Create additional revenue for your business

- Manage rates and commissions

Payout network

Reduce cross-border payout risk by relying on our extensive and efficient payout network. Payments orders are duly executed and recorded for tracking.

- Powerful payment switch orchestrates payment transactions

- Transparent payout accounting system for easy tracking

- Leverage FX opportunities

Bills payments

Let your customer pay bills virtually from anywhere in the world; be it one-time payments, recurring bills, subscriptions, school fees, donations, charities and more.

- Instant local or international bill payments

- Customers can pay bills for relatives irrespective of location

- Easy automation of recurring billing

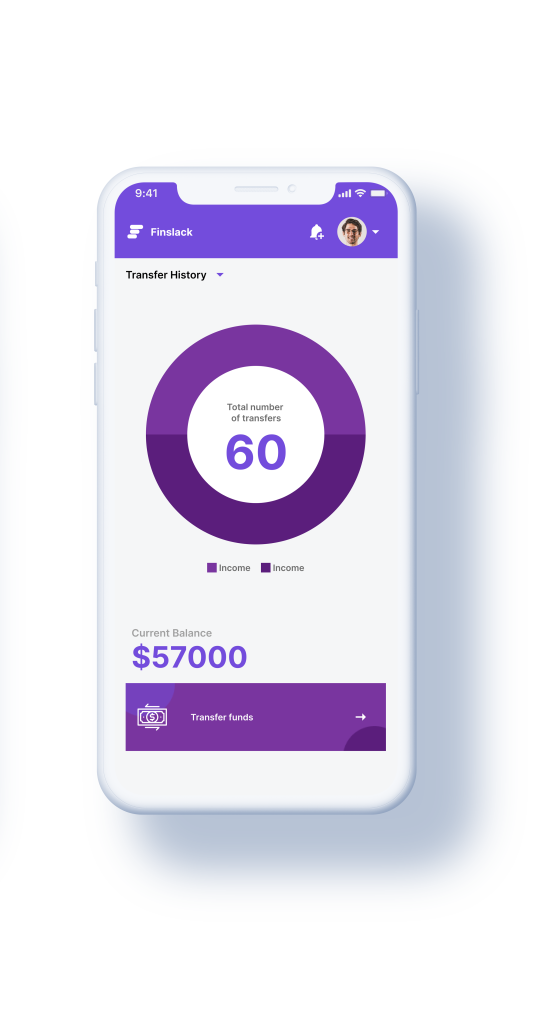

Mobile money

Allow customers to seamless make payments to unbanked beneficiaries worldwide. Beneficiaries can access funds on mobile as withdraw cash via agents.

- Enable mobile money transactions in over 250 countries

- Real-time currency exchange or conversations

- Support deposits and account balances in crypto

Manage agency/branch network

Reach more customers through the creation and management of an agency network worldwide. Your customers can deposit, withdraw, pay bills, check balances and more through your agent locations.

- Full agent management technology for fee sharing, agent hierarchy, reporting and more

- Setup rate and commission for agents and assign roles (sub-agent or super-agent)

- Monitor agents’ activities and finances through Super Admin access

Greate value for money

Complete the design, testing, deployment and launching of your remittance app within days, not months.

Increase Revenue

Capture new revenue streams made possible by introducing payment services to customers.

Enhance Customer Experience

Design and deliver a simple, fast, and secure cross-border payment experience to users.

See how Chromepay provided customers, merchants & small businesses with quick and secured digital payment platforms

Key features that make it all possible

Fully Compliant

We own compliance and have done the heavy lifting of reducing the risk of financial fraud so you can run your business smoothly.

Maximum Security

Prevent unauthorized access to tools using cutting-edge security technologies. Distribute access rights to your staff with varying authorizations.

Customizable

Our suite of flexible components and APIs lets you build out bespoke functionalities, integrate third-party services and brand your product.

Reliable

Finslack robust and multi-tenant architecture allows multiple clients' systems to run concurrently on a central server with 99% system uptime.

PARTNERS

Our Plug and Play Ecosystem

Our industry-leading partners are pre-integrated into Finslack to provide solutions across

Banking-as-a-Service, credit, loan management, KYC and more.

See what else you could build

The easiest way to launch your financial product