A new way to offer Electronic Money services

Launch full-scale electronic money web portal or mobile app to let your customers easily store, send and receive money globally without a bank account.

No EMI license? No problem! Leverage ours for a faster launch

An electronic money institution license is mandatory to meet the regulatory requirements of setting up an e-money institution.

Save time the time and costs it takes to acquire a license by building on the EMI licenses of our host banks. Choose host banks from our ecosystem or onboard yours.

Customise your product with ease

We take care of the backend features of your e-money application so you can focus on delivering a customer interface that supplies the most value to end-users.

- Customer screening and monitoring service

- Payment hub and accounting system

- Processing platform (card management System)

- Customize and brand your web portal and mobile app (iOS and Android) for customers

Offers customers exceptional e-money experience

Seamless onboarding

Onboard customers with mobile apps and dashboard screens across multiple channels. Automate onboarding processes like eKYC checks, auto approvals and more.

Self-onboarding

Omnichannel onboarding process

Advanced Individual and business KYC/KYB levels

Photo & video verification

Instant payments

Let customers instantly send & receive money, make transfers and cross-border payments via card, QR codes, wire transfers, cryptocurrencies and others.

Charge transparent fees and taxes

Bill payments

Peer-to-Peer transfers

Mobile POS for merchants

Issue e-wallets and e-money accounts

Offer complete and personalized e-wallets to users. Multi-currency account feature let users create multiple accounts and hold funds in multiple currencies. Transfers between accounts are fast and easy.

Issue account number, IBANs, sort codes, SWIFT/BIC

Multi-currency accounts support

Generate reports, analyse expenses, and much more

Add real-time currency exchange

Enable quick currency conversation and exchange features in your product—whether it's fiat to fiat, cryptocurrency to cryptocurrency, fiat to cryptocurrency and vice versa.

Set up commission charges to offer customers the best rates

Real-time currencies conversation

Competitive commissions

Seamless account issuing & reconciliation

Issue bank and internal virtual accounts. Automate account reconciliation between host banks and balances on your system or upload account statements into Finslack and reconcile manually.

Automatic and manual account reconciliation

Virtual Closed Loop or Opened Loop accounts

Scheduled and Recurring Payments

Allow customers the flexibility to schedule payments for later executions and automate all types of recurring payments—payroll, commissions, bills, and more—at the click of a button.

Schedules payments and easily adjust before due dates

Automate recurring payments

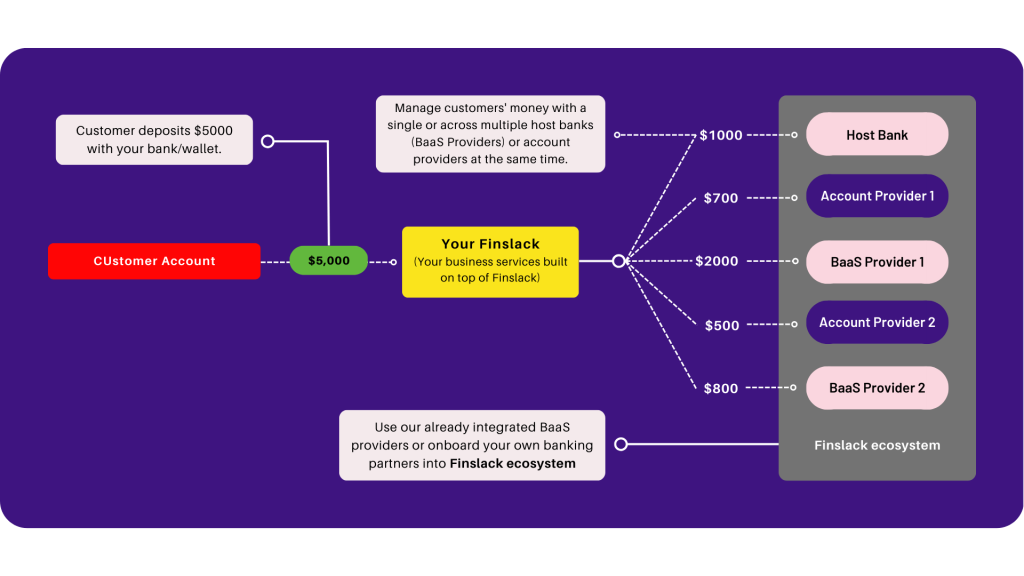

Hold customer funds with multiple host banks

Break free from partner-locking a single host bank or Banking-as-a-Service platform. Plug into Finslack’s fast-expanding ecosystem of banks and BaaS platforms so you can hold customers’ money across multiple banks at a time without friction.

See how Finslack helped Kogopay build a socially conscious startup that provides virtual IBANs and mobile wallets to customers

Key features that make it all possible

Fully Compliant

We own compliance and have done the heavy lifting of reducing the risk of financial fraud so you can run your business smoothly.

Maximum Security

Prevent unauthorized access to tools using cutting-edge security technologies. Distribute access rights to your staff with varying authorizations.

Customizable

Our suite of flexible components and APIs lets you build out unique functionalities, integrate third-party services and brand your product.

Reliable

Finslack robust and multi-tenant architecture allows multiple clients' systems to run concurrently on a central server with 99% system uptime.

PARTNERS

Our Plug and Play Ecosystem

Our industry-leading partners are pre-integrated into Finslack to provide solutions across

Banking-as-a-Service, credit, loan management, KYC and more.

See what else you could build

The easiest way to launch your financial product